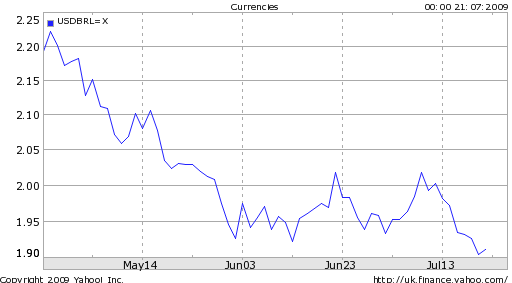

In the last three months alone, the Brazilian Real has risen by an impressive 15% against the Dollar alone. What’s driving this impressive importance? The lead paragraph for one article offered the following encapsulation: “Brazil’s real climbed to the highest in more than nine months as stronger-than-estimated corporate earnings, rising equities and higher metal prices bolstered the outlook for Latin America’s largest economy.”

These factors certainly represent a good starting point for any analysis of the Real. As signs continue to emerge that the global economy - and China specifically - have turned a corner in their fight to overcome recession, commodities will likely continue to rally, which is excellent news for Brazil bulls. In addition, “May industrial production and especially retail sales came in stronger than expected, following incipient signs of improvement in labor and credit conditions, consumer and investor confidence, and inventory levels.” As a result, after a modest contraction in 2009 (the bulk of which took place in the first quarter), 2010 is expected to mark a return to solid growth, with estimates ranging from 3.5% to 4.5%, rising to 5% in 2011.

The Central Bank of Brazil, however, is not necessarily on the same page. Last week, it cut rates to a record low of 8.75%, in order to ensure that Brazilian monetary policy remains easy enough to support growth. While this is an unwelcome development for carry traders, there are a few mitigating circumstances. First, considering that Brazilian inflation is projected to average 4.5% in 2009, this still affords investors a solid 4% real return, without factoring in currency fluctuations. Second, Brazilian rates are still significantly higher than levels in industrialized countries, such that the interest rate differential which makes Brazil attractive has been carefully preserved. Finally, while precise forecasts vary, the Central Bank is expected to begin hiking rates as soon as the end of this year, with further hikes throughout 2010.

The Central Bank has also been busy on other fronts. Thanks to a healthy trade surplus, its foreign exchange reserves are burgeoning, recently touching a record $209 Billion. This figure well exceeds Brazil’s outstanding debt, which gives it great flexibility in determining how to allocate these reserves. Already, the Central Bank has begun to pare down its holdings of US Treasury securities, in search of higher-yielding alternatives. In addition, the Central Bank has taken to intervening regularly in the forex spot market, in a vain effort to stem the rise of the Real.

In the short term, analysts are now lining up around various technical levels, backed by little real fundamental analysis. “Moreover, without fundamental economic news showing better times ahead for the U.S. economy, principally, then the BRL1.90 support will remain cemented in place,” offered one analyst. “You show me some more good news and the support will be closer to 1.85,” argued another. It looks like traders are just looking for excuses to keep bidding up the Real.

July 20th 2009

China’s Forex Reserves Cross $2 Trillion, but Still No Signs of Diversification

After a brief pause, China’s foreign exchange reserves have resumed their blistering pace of growth: “The reserves rose a record $178 billion in the second quarter to $2.132 trillion, the People’s Bank of China said today on its Web site. That dwarfs a $7.7 billion gain in the previous three months.” Considering that the global economy remains embroiled in the worst recession in decades, this is frankly incredible. [Chart below courtesy of WSJ].

As far as currency traders are concerned, this development has two important implications, the first of which concerns the Chinese Yuan (also known as RenMinBi or RMB). A quick parsing of trade and capital flows data reveals that the majority of the $178 Billion came from unconventional sources. “The trade surplus was $34.8 billion in the second quarter and foreign direct investment was $21.2 billion.” Currency fluctuations (i.e. the depreciation in the Dollar relative to other major currencies) can explain a small portion, “leaving the bulk of the increase in the reserves unaccounted for.”

In short, most of the capital now flowing into China is so-called “hot money,” chasing a piece of the action in China’s surging property and stock markets. The benchmark stock index has risen 75% this year, making it the world’s best performer. In short, China is once again “caught in a squeeze similar to the one that bedevilled policymakers earlier this century, with a flood of hot money trying to force the government’s hand on the currency.” Either it allows the RMB to resume its upward path against the Dollar, or it raises interest rates rapidly to head off inflation. With the money supply now growing at an annualized rate of 30%+, the government is running out of time on this front.

The second implication concerns the composition of China’s reserves. You can recall that in recent months, Chinese officials have become more vocal about ending the Dollar’s role as the world’s reserve currency, and have even taken token steps towards achieving that goal. But the latest analysis suggests that when push comes to shove, China is still firmly behind the Dollar: “Estimates suggest around 65% of China’s official holdings are in U.S. dollar assets, and the remainder are denominated in euro, yen, sterling and other currencies. This mix has been relatively stable as the Chinese government continues to place the bulk of its reserves in U.S. Treasury securities.”

In fact, “stable” is an understatement. While other Central Banks are gradually paring their holdings of US Treasuries, China is adding to its own stockpile. Already the world’s largest holder of Treasuries, China added another $38 billion in May, for a total of $800 Billion. “On the contrary, Japan, Russia and Canada were sellers of US assets in May. Japan, the second-biggest international investor, reduced its total holdings by $8.7 billion to $677.2 billion.” Meanwhile, Zhou XiaoChuan, governor of China’s Central Bank has endorsed the current composition of reserves: “Despite the $800 billion in U.S. Treasuries, it is a diversified portfolio overall.” This certainly represents a step backwards for Mr. Zhou, who only a couple months ago was leading the charge for a global reserve currency.

Perhaps over the longer-term, it can begin to take steps to dislodge the Dollar, but for now, it appears that China has accepted the status quo. As one analyst observed, “We do expect China to increase its purchase of gold and other commodities over time, but these markets are just not big enough to make a meaningful dent in the structure of the overall FX holdings. For example, if China decided to hold 5 percent of its current $2 trillion reserves in gold, it would need to buy …the equivalent to about one year of world production. For other hard commodities, the cost of storage is high and prices fluctuate wildly.”

China did recently appoint a new official (an economist trained in the US) to manage its reserves. “The move isn’t likely to fluster foreign-exchange markets or herald any change in China’s exchange-rate policy and reform.” Still, Chinawatchers are advised to continue to monitor the situation closely for any signs of discontinuity.

No comments:

Post a Comment